Global interest in offshoring is growing as a solution to address rising talent shortages affecting numerous countries. As more organizations realize the advantages of offshoring, many have begun exploring different overseas locations where they can set up their offshore teams. Among the numerous destinations available, the Asia Pacific (APAC) region stands out, offering a highly skilled workforce, cost-efficient services, and robust infrastructure.

Encompassing Southeast Asia, East Asia, South Asia, and Oceania, APAC is home to two of the most popular offshoring hubs: India and the Philippines. For companies planning to relocate their offshore accounting to APAC, India and the Philippines consistently rank as top choices.

Overview of India and the Philippines as Offshoring Destinations

India has long been recognized as the world’s outsourcing powerhouse. Its information technology (IT) and business process outsourcing (BPO) sectors are expected to generate $350 billion in revenue by 2025. The country also has over 5.4 million people employed in the IT-BPO industry.

Indian cities like Bangalore, Hyderabad, and Mumbai are renowned for their tech-savvy workforce. These advantages make India particularly attractive for companies looking for specialized services in IT and knowledge process outsourcing (KPO).

However, despite India’s reputation of being first movers in the BPO industry, the Philippines has become an alternative favorite hotspot for offshore talent in APAC. This is especially true for voice-based support and financial services like offshore accounting. In fact, 2-3% of companies are shifting from India to the Philippines for these roles.

This trend is not surprising, as the Philippines has a strong pool of English-speaking professionals and a business environment that’s compatible with Western corporate practices. The Philippines is the preferred destination for firms looking to streamline their accounting operations without compromising on expertise.

How the Philippines Excels Against India for Offshore Accounting

Let’s look deeper into how the Philippines surpasses India when it comes to offshore accounting services.

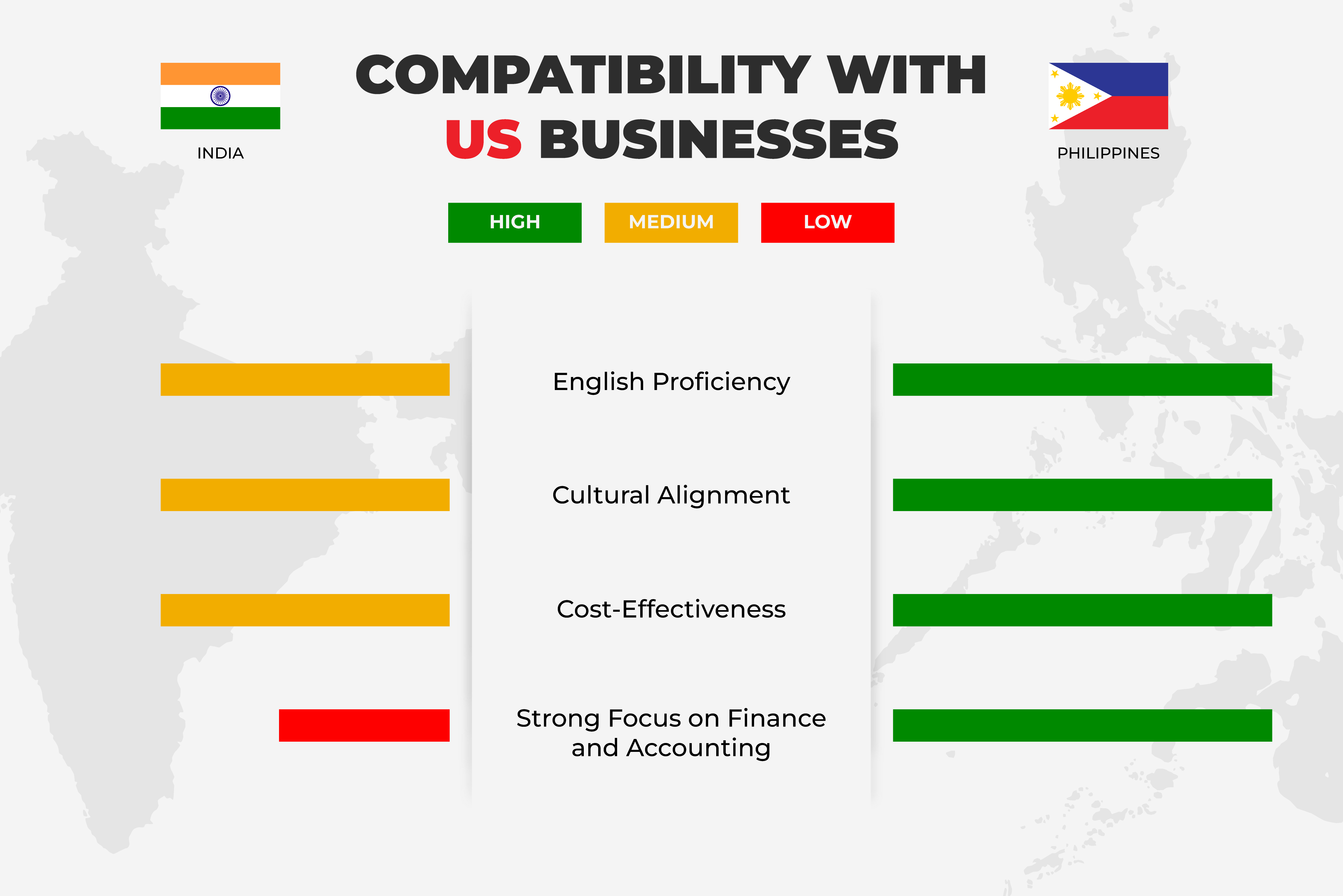

● Higher English Proficiency

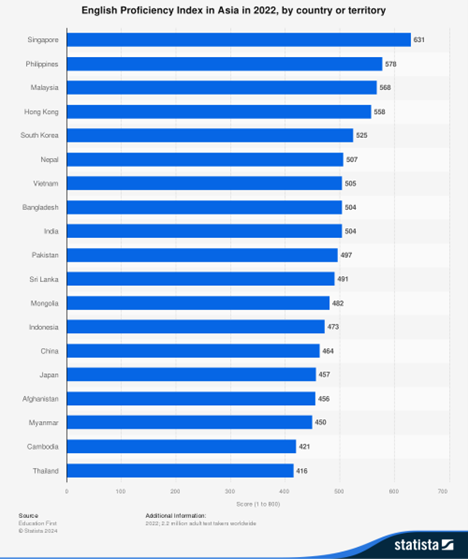

One of the key advantages the Philippines has over India is its high level of English proficiency. The Philippines has the second highest English Proficiency Index score in Asia, coming in at 578 (out of a maximum 800). India is only ninth with 504 points.

This image is taken from Statista.

Filipino professionals have strong English skills thanks to an education system that emphasizes the English language from primary school through higher education. This positions the Filipino workforce to excel in roles that require effective communication with Western clients.

While India has a large number of English speakers, regional accents and communication styles may sometimes pose challenges in client-facing roles. This may be a hindrance, especially in sectors like accounting, where accuracy and clarity are critical.

● Cultural Alignment

The cultural compatibility between the Philippines and Western countries, particularly the US, plays a significant role in the country’s success as an offshore accounting destination. Due to the Philippines’ historical ties with the US, Filipino professionals generally have a better understanding of Western business practices, client service expectations, and work culture.

In InterNation’s Expat Insider 2023, the Philippines ranked ninth as the best place for work and leisure purposes, while India is in 40th place. The report provides insights into the everyday lives of over 12,000 expats worldwide while they’re abroad. This data indicates that foreign clients recognize the compatibility of the Philippines and other countries in terms of working culture.

India, while highly skilled, sometimes faces challenges in adapting to Western business norms due to more pronounced cultural differences. For example, cultural nuances can influence communication styles. Some Indian professionals might be more indirect in their communications, which can often lead to misunderstandings.

● Cost-Effectiveness

Both countries offer significant cost savings in offshore accounting, but the Philippines generally has a lower overall cost of labor and operational expenses compared to India.

✔ Companies offshoring to the Philippines can achieve significant operational cost savings, with estimates suggesting reductions of up to 70%.

✔ Based on Livingcost‘s database, Filipinos have an average salary expectation of $392, compared to India’s $670.

Although India has a more affordable cost of living, the Philippines has a much lower average monthly salary expectation. This makes the latter more attractive for offshore outsourcing – to save money without compromising on quality of talent and service.

Further, the rising competition for talent in India’s major outsourcing hubs is driving up wage expectations. As a result, the cost of hiring top talent in India has steadily increased, especially in hotspots like Bangalore, Mumbai, and Hyderabad.

● Strong Focus on Finance and Accounting

Filipino Certified Public Accountants (CPAs) and Certified Management Accountants (CMAs) are sought after by international companies for their proficiency and high adaptability in the workplace. The Philippines has carved out a niche in finance and accounting, with expertise that is on par with first-world countries like Australia, the UK, and the US.

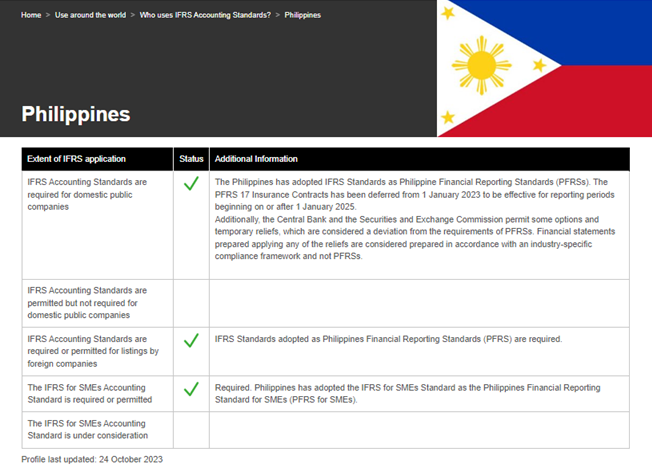

One reason for this is because Filipinos adhere to accounting standards (i.e., GAAP and IFRS) that are aligned with the US and many other nations. In the Philippines, the IFRS is practiced and required for publicly listed companies, foreign companies, and SMEs. Adopting these standards means that Filipino accountants are well-versed in international accounting practices and can keep up with the reporting requirements of global clients.

Use of IFRS Standards by Jurisdiction: Philippines

This image is taken from ifrs.gov.

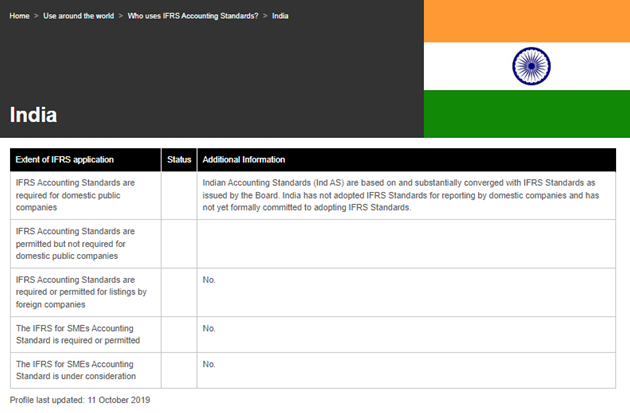

On the other hand, while India is also competitive in the accounting space, its strength traditionally lies in IT outsourcing and software development. Moreover, its adoption of international accounting standards is also still voluntary and not yet fully practiced by its domestic public companies. This means that the Philippines is better positioned to meet the needs of companies specifically looking for accounting expertise.

Use of IFRS Standards by Jurisdiction: India

Offshore to the Philippines with EVES

As the global accountant shortage drives organizations toward offshoring, the Philippines and India are the top contenders for best offshoring locations. While India remains a formidable player for its history as a pioneer in IT outsourcing, the Philippines offers distinct advantages when it comes to client-focused and collaborative accounting needs.

Philippines’ exceptional English proficiency, cultural compatibility, and accounting standard alignment puts businesses in a better position to scale, save costs, and seize new opportunities. If your priority is building a reliable, client-focused team that understands your business goals and fosters lasting relationships, the Philippines is the ideal choice for you.

Partner with Elite Virtual Employment Solutions (EVES) today and discover how a dedicated offshore accounting team in the Philippines can elevate your business.

Contact us at https://evesolutions.net/ or (747) 300-3234 to learn more about how we can make your Philippine offshoring work.

Leave A Comment

You must be logged in to post a comment.